Quantum computing applications to financial modeling that is banks and firms use quantum tech to solve hard math way faster than old computers. Quantum systems can perform portfolio pick and risk check with greater accuracy and less guesswork. They assist in detecting concealed connections in massive data sets and are able to perform complex market simulations faster. As traditional tools have started to run up against their power limits, many industry leaders are turning to quantum for an edge. For teams who want to keep up, quantum provides a definitive route to accelerate work and extract additional value from their financial models. The following sections demonstrate practical applications companies have made of quantum and how it impacted finance’s future.

Why Quantum Computing Revolutionizes Finance: The Quantum Edge

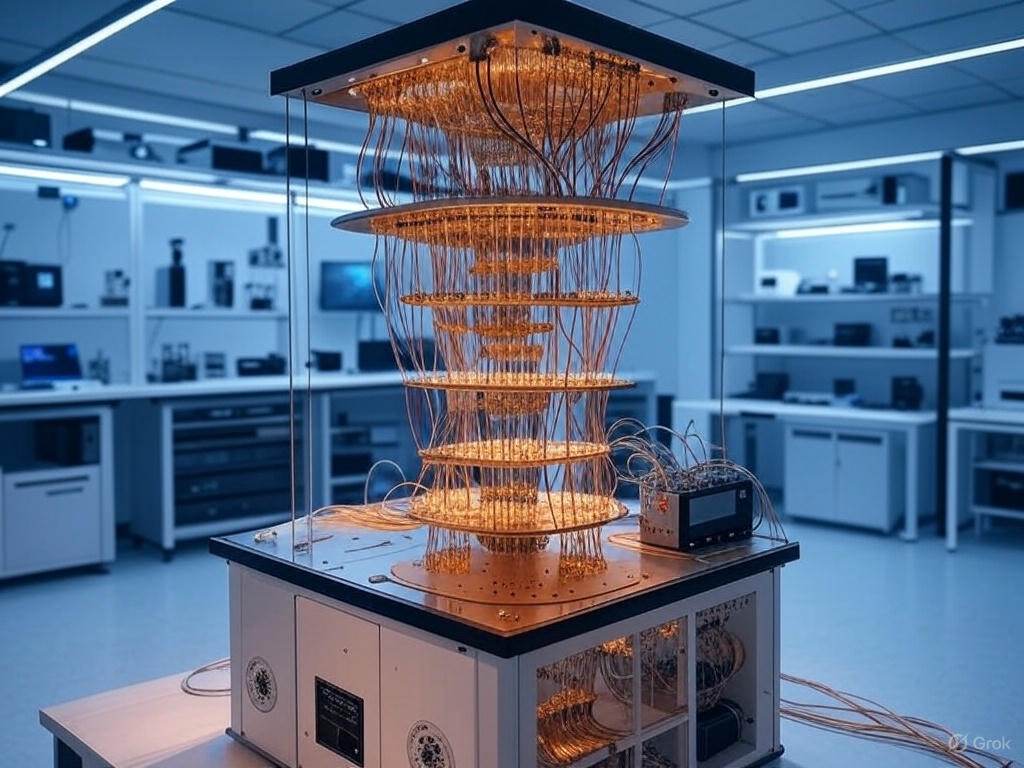

It allows banks and other financial services organizations to tackle hard problems way faster than’s possible today. With quantum computing use cases, it’s simple to chew through massive, knotted models in risk, pricing, and portfolio work, because quantum bits (qubits) can test multiple outcomes simultaneously. In this manner, banks can perform stress tests or predict market movements in minutes, not days, achieving results that are more realistic.

In investment and corporate banking, quantum algorithms help with tough choices. These tools can process huge piles of data to pick the best mix of assets, spot market chances, or check credit risk. For example, classical models may take hours to price complex options or interest rate swaps, but a powerful quantum computer can do the same work in a fraction of the time. This edge helps banks set prices better, spot risk sooner, and serve clients well.

Quantum technology will transform risk management and portfolio performance. It allows banks to perform more in-depth stress tests for “what if” market shocks or unexpected value swings. Quantum machine learning, a new field, is currently being used to scan market trends and improve predictions. This allows banks to identify risks before they become large, or recognize opportunities others miss. From more intelligent lending decisions to more precise fraud heuristics, quantum models achieve more in less time with even fewer errors.

For financial firms speed isn’t just a perk—it’s a win. With quantum, they can check more of it, run more tests, and make decisions in real time. This boost in speed and precision allows them to maintain an edge in rapidly evolving markets. Quantum computers can crunch the mammoth datasets found in world finance, so banks can extract intelligence from more streams and make moves ahead of the herd.

There’s a danger to observe. Quantum computers are going to crack today’s encryption in a decade, jeopardizing data and the economy. Firms need to plan for this threat now because the price of delay is potentially steep. Nevertheless, the potential for faster, more precise, and more secure finance is apparent if banks can apply quantum technology properly.

Real-World Quantum Use Cases Transforming Financial Modeling

Financial firms are beginning to apply quantum algorithms for enhanced risk analysis, intelligent pricing, and robust fraud prevention, showcasing potential use cases of quantum computing in the financial services sector.

- Portfolio optimization with greater accuracy and speed

- Advanced derivative pricing and faster scenario modeling

- Real-time risk simulation and stress-testing

- Speeding up algorithmic trading for competitive edge

- Enhanced fraud detection and security using quantum tools

Portfolio Optimization: Maximizing Returns with Quantum Precision

Quantum Approximate Optimization Algorithm (QAOA) enables companies to optimize portfolios in ways classical methods are unable to. Quantum computers can search significantly larger solution spaces quickly, enabling asset managers to select the optimal combination of assets and minimize risk. Companies such as Fidelity and Barclays are piloting quantum approaches to optimize their investment strategies.

Goldman Sachs has demonstrated how QAOA can assist in discovering improved asset allocations, particularly within large portfolios. Quantum optimization accelerates the computations, allowing managers to respond even more quickly to market movements. That is less risk and more opportunity to increase returns, an objective investment teams globally eye.

Derivative Pricing: Faster, Smarter Valuations

Quantum can price options and other derivatives much quicker. JPMorgan Chase is exploring quantum algorithms to optimize risk and trading models. Quantum Monte Carlo reduces the runtime for pricing simulations which translates into more accurate results.

Goldman Sachs is applying quantum models to complex financial products. They assist banks swiftly price and analyze large data sets – something classical models have a hard time doing. Quantum approaches are already holding real potential for companies requiring rapidity and precision in our current markets.

Risk Simulation: Stress-Testing Markets in Real Time

Quantum Monte Carlo allows traders to simulate thousands of market cases in little time. IBM is collaborating with banks to develop quantum tools that simulate risk in real time. Quantum amplitude estimation allows teams to evaluate risk in fewer runs — saving both time and money.

This allows companies to stress test markets for sudden crashes or volatility more frequently. Better forecasts imply more resilient strategies and less risk of being blindsided. Quantum modeling can transform corporate perceptions of risk.

Algorithmic Trading: Gaining a Quantum Speed Advantage

Quantum optimization assists trading desks to scan and identify patterns in massive data sets quickly. This aids them identify arbitrage and take split-second choices. Or quantum trading models that give firms a real-time edge in high-frequency markets.

Quantum tools can assist traders identify trends and forecast price movements, allowing them to strike before the herd. This velocity and insight keep firms steps ahead in global markets.

Fraud Detection: Spotting Anomalies with Quantum Power

Crédit Mutuel & IBM use quantum to spot fraud by detecting trends & anomalies quickly. Quantum machine learning tools such as QSVM can scan millions of transactions for pointers of fraud. Standard Chartered is exploring quantum for enhanced security.

Quantum cryptography might make financial data more secure. As banks lose billions to fraud every year, quantum tech could aid in reducing losses and protecting customer data.

Demystifying Quantum Algorithms: How They Power Finance

Quantum computing is revolutionizing how financial services firms address financial challenges with qubits and novel approaches to data. Unlike regular computers, a powerful quantum computer processes significantly more information simultaneously, which is critical for identifying patterns and forecasting in the finance industry. This enables banks and other financial institutions to reduce fraud and enhance credit checks, while saving time and money.

- Quantum algorithms, meanwhile, harness qubits — which are 1, 0, or both simultaneously — allowing computers to process multiple possibilities simultaneously.

- Superposition and entanglement allow quantum computers to identify patterns and solve problems more quickly than classical computers.

- Quantum algorithms can process these complex tasks such as risk modeling, portfolio balancing and fraud detection more efficiently.

- Continued improvements in hardware and error correction are enabling companies like IBM and D-Wave to transition these tools into real-world finance.

- These algorithms are reinventing the way financial models are constructed, simplifying the prediction of trends and optimization of investments.

Quantum Annealing: Solving Optimization Challenges

Quantum annealers specialize in hard optimization challenges, such as selecting the optimal portfolio of assets, which is one of the promising quantum computing use cases in finance. These powerful quantum computers can analyze thousands of potential portfolios simultaneously, identifying the most lucrative options more quickly than traditional methods. For instance, D-Wave’s technology is already being deployed by financial services firms for portfolio optimization, showcasing early successes in managing vast numbers of variables that would overwhelm classical computers.

By addressing financial problems like portfolio balancing, quantum annealing aids decision-makers in evaluating numerous factors—risk, return, and market constraints—without extensive number-crunching. This results in quicker, more accurate insights that keep pace with volatile financial markets. The adoption of quantum technology is gaining momentum for tasks such as cash flow management and fraud detection, where numerous variables influence decisions. Its ability to uncover solutions that are too time-consuming for classical machines highlights a genuine quantum advantage as the technology continues to evolve.

Variational Algorithms: Flexible Tools for Market Insights

Variational quantum algorithms, for example the variational quantum eigensolver (VQE), can adapt to different financial models by tuning quantum systems to fit real-world data. These enable firms to construct improved trading, risk and pricing simulations.

What makes them useful is their versatility. They can function with new data or evolving market rules — perfect for volatile economic environments. Banks and quantum tech companies often collaborate to optimize these algorithms for actual market requirement, advancing the frontier of predictive finance.

Consequently, such variational algorithms are assisting to increase the precision of financial predictions. By rapidly simulating numerous possibilities, they assist managers in identifying patterns and fine-tuning strategies before threats escalate.

Quantum Amplitude Estimation: Accelerating Risk Calculations

Quantum amplitude estimation, a core tool for speeding up Monte Carlo simulations that are often used in finance for risk and price estimates.

Leveraging quantum mechanics, this approach reduces the sample complexity, thereby accelerating risk models. IBM and Cambridge Quantum are pioneers in this arena, proving that quantum amplitude estimation can take tasks that used to be slow, and make them fast.

Armed with this tool, banks can obtain risk and pricing solutions in minutes, rather than hours. It enables faster, more efficient risk management and keeps firms nimble in rapid markets.

Hybrid Quantum-Classical Systems: The Bridge to Quantum Finance

Hybrid quantum-classical systems combine the strengths of both quantum technology and classical computing. Such a hybrid approach enables financial institutions to do more with less, particularly as quantum computing hardware currently requires extreme cold temperatures to function. By interleaving the two systems, companies can leverage their existing infrastructure while incorporating cutting-edge quantum resources to tackle more difficult challenges in finance, including various quantum computing use cases.

Quantum bits, or qubits, operate in a superposition of zero and one, which implies they can contain far more information than the plain bits employed in present-day computers. For Monte-Carlo simulations, popular for risk and uncertainty in financial modeling applications, hybrid systems provide an avenue to accelerate outcomes. While classical Monte Carlo slows down as data and questions get bigger, the quantum model can shorten the time to answer, reducing the estimation error. Grover’s algorithm, for instance, is a quantum method that searches things quicker in large unsorted databases, making it particularly useful in the financial services sector.

It’s not that most banks and asset managers are prepared to make a complete transition to quantum computing adoption. Hybrid models allow them to mix quantum algorithms, such as Grover’s or Shor’s, with their existing infrastructure. So, they don’t have to reinvent everything from zero—they simply insert new components that assist hard tasks. It reduces risk and expense. By beginning with hybrid-baby steps, firms can develop skills and tooling as they wait for better hardware. Fault-tolerant true quantum computers with millions of qubits are still not here. Until then, hybrids bridge the divide.

Researchers are already leveraging hybrid systems to extract quantum advantages in risk analysis, option pricing, and even cryptography. For instance, the quantum fourier transform allows factoring of large numbers quickly, which is relevant for both security and financial solutions. These hybrid systems allow groups to experiment with novel concepts using existing technology, without needing to wait for ideal quantum devices.

Hybrid quantum-classical systems are what make quantum finance real today, not just a dream for tomorrow. The potential use cases for these systems in the financial services industry continue to grow, paving the way for a quantum computing revolution in financial transactions and risk analytics.

Overcoming Barriers to Quantum Adoption in Finance

Quantum computing promises to remake financial modeling applications, but its trajectory is sculpted by technical barriers, expense, and talent shortfalls. Banks face several challenges before quantum computing adoption can become a regular part of risk analysis and trade optimization.

High cost of quantum hardware and tech investments

Scarcity of quantum-skilled professionals

Challenges in integrating quantum with existing systems

Complexity in adapting classical algorithms to quantum models

Lack of standards for quantum algorithm development

Data security and encryption concerns

Uncertainty around return on investment

Hardware Limitations: Navigating Current Quantum Constraints

Quantum hardware remains nascent. Most devices run with noisy qubits, limited coherence times, high error rates–tricky for large-scale finance jobs. The NISQ era, in other words, means most quantum machines aren’t ready to tackle complex risk analysis or portfolio optimization without error. This constrains the extent to which banks or asset managers can scale their quantum modeling.

Active research is attempting to increase qubit stability and minimize errors. Without more robust hardware, real-world finance cases are largely still in pilot mode. The demand for improved quantum chips represents a technical obstacle that delays broader adoption, yet consistent advancements in laboratories foreshadow the development of more stable devices in the future.

Talent Scarcity: Building Quantum-Ready Finance Teams

Not many folks out there these days who combine finance expertise with quantum expertise. This scarcity compels banks to battle for scarce talent or start new teams from scratch. Upskilling is critical, and collaborations with universities or initiatives such as IBM’s Qiskit assist in bridging the divide. Even then, most finance leaders can’t find or train the right talent mix.

Education and industry partnerships are essential to cultivating quantum-ready teams. Financial institutions endorsing continuous learning can accelerate the transition, facilitating adaptation as quantum tools evolve.

Integration Costs: Balancing Investment and ROI

Quantum adoption is costly. Buying hardware, training staff and changing workflows, it all adds up. Without standards or established quantum algorithms, many firms are reluctant to commit. Pilot projects and hybrid setups — where quantum and classical tech work side by side — can help demonstrate value prior to full deployment.

Working with tech partners to reduce costs and minimize risk. Firms have to plan in order to make the case for quantum investments, balancing potential savings in transaction costs or modeling accuracy against upfront expenditures.

Preparing for a Quantum-Proof Financial Future

Quantum computing is poised to transform financial services, particularly through its quantum computing use cases. It will accelerate the resolution of difficult financial problems that presently require years, even for the most powerful systems. A task that would take 100 years with today’s tools, a powerful quantum computer could accomplish in a matter of hours. This giant shift can enable banks, funds, and markets to identify risks, price assets, and recognize trends with unprecedented speed and granularity. The next ten years are crucial; financial firms must prepare today because these timelines are tight, and the implications are significant.

Taking the leap into quantum technology in finance will yield long-term rewards. More firms are recognizing this, with quantum computing investments for finance anticipated to reach $19 billion by 2032. Quantum can provide enhanced models for things such as market risk, credit scoring, and fraud checks. It can help price financial instruments like stocks, bonds, or loans in ways that were previously unimaginable. Companies that leverage quantum for analytics will identify trends and respond more quickly than their competitors, giving them a significant advantage in the financial services sector.

Keeping up with quantum advancements is not only prudent; it’s mandatory. The rapid rate of quantum computing research results in frequent new breakthroughs. Financial experts should read quantum finance papers and join communities working on these challenges. Some banks and funds even partner with start-ups or labs to test quantum tools on real-world data. This practical labor enables teams to learn faster and stay current with new technology.

A significant risk is the potential threat to current encryption methods. Quantum machines could crack the codes that secure financial transactions today. This is where quantum-resistant cryptography, such as lattice-based systems, comes into play. These new codes are essential for keeping payments and data safe from quantum hacking. Standards for these systems are still being established, and it will take years to implement the switch, so banks need to begin trials and plan upgrades now.

Real-time market modeling, where quantum will matter. With this tech, banks could conduct multiple ‘what-if’ checks simultaneously, identify stock fluctuations, or simulate the stress of an entire market within minutes. This assists companies visualize dangers and respond prior to premiums shifting.

Conclusion

Quantum tools now influencing how finance teams crunch big data and risk. Banks and funds conduct experiments to value assets, detect fraud, and monitor trades with greater swiftness and less heuristics. Teams get quicker routes to create and validate models, from stock prices to stress tests. Quantum tech continues to expand, transforming how professionals prepare for new regulations and risks. To keep up, executives run little quantum pilots in their stack, train teams on basics. Companies establishing quantum expertise now have an advantage as the industry matures. For teams prepared to get their hands dirty, there’s no time like the present to investigate where quantum tools align with their objectives and process. Contact us to learn more or schedule a demo.